WHAT WE DO

Open your business with the most suitable statutory structure, the best tax regime, etc. Start the right way!

With us, you will benefit from all the support a new business needs to receive, regarding business viability analysis, tax planning, guidance, and clarifications on everything you need to know before opening your business.

After it's opened, your business will continue to receive all the attention that a new business deserves. It will also receive all necessary supervision and guidance so that you can calmly focus on your project. After all, more than opening your business, we want it to be successful!

We ensure the execution with rigor, transparency, and closeness to your company's accounting with agile and trustworthy processes.

We produce monthly reports focused on management to help you evaluate and make important decisions for your company's growth.

Your accounting will be executed by a team of Accountants qualified and Certified by OCAM.

We offer the client the option to choose a more personalized service, which involves placing one of our experts at your office full-time, guaranteeing greater participation in the company's business.

Thorough examination aimed at evaluating the management process, focusing on aspects such as corporate governance, risk management, and compliance with regulations to identify any deviations and vulnerabilities the organization may be exposed to.

Our audits are conducted by professionals of the highest technical standards, who act as consultants, offering suggestions and solutions to improve the management and control of organizations.

We conduct audits aimed at strengthening the reliability of the information for the use of partners/shareholders, investors, creditors, regulators, citizens, administrators, and other stakeholders.

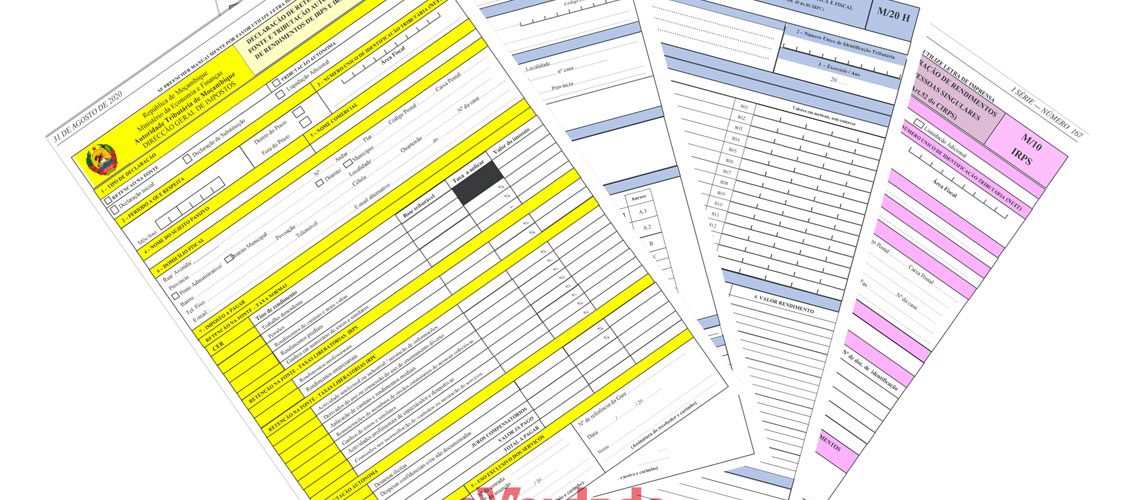

We have a team of specialists who handle the preparation and submission of all required documents to the tax authorities in Mozambique. Our main goal is to be your advisors on tax matters to ensure the legality of all adopted procedures.

We conduct a thorough analysis of your business to guide you on the best tax regime, take care of your declarations, and handle your tax obligations with absolute rigor. When the laws change, we adapt and keep you informed.

Count on our advisory services to ensure your company is in compliance with tax obligations.

We take care of all tasks related to your relationship with your employees. You can rely on constant support from a team capable of guiding you through all matters, with the aim of reducing all types of labor risks.

More than just preparing the payroll, we provide complete support, from advising and controlling the application of labor laws, hiring, and residence permits for foreigners, to updating the individual employee files.

With your company and team well taken care of, achieving your goals becomes much easier.

We ensure the payment and receipt of your bills on time, providing cash flow and aging balance reports.

We issue standardized and customized reports that will support the management of your business. The advantages are that the client has their finances organized and gains more time to focus on their business, in addition to reducing the cost of maintaining an internal team.

• Accounts payable and receivable management; • Cash flow projection; • Issuance and dispatch of billing documents; • Management and financial reports; • Direct contact with debtors, creditors, and banks.